The Intersection of Volatility and Bureaucratic Backlog

2024 and 2025 have introduced their share of surprises. tiny companies have seen interest rate hikes, industry fluctuations, source chain instability, and now confront the at any time-escalating menace of trade wars on a number of fronts. During this environment, hard cash isn’t just convenience – it’s tactic. That’s why a lot more business owners are exploring Inventive funding solutions like the Employee Retention Credit financial loan to unlock frozen cash and keep their companies fiscally adaptable.

Enable’s have a look at how corporations are using ERC funding not merely to survive IRS delays—but to construct extensive-phrase power within an uncertain world.

The ERC Backlog: A Real dilemma for progress companies

The IRS has slowed processing for ERC claims appreciably. Some companies are observing wait around periods exceeding 12–24 months, without distinct timeline for resolution.

That’s developed a irritating circumstance, in which firms have now capable with the ERC, recognize that the cash are owed to them and coming inevitably, but they are able to’t depend on when or rely upon the availability of All those resources to safeguard their company.

This problem is doubly frustrating for smaller companies which have been in the expansion cycle. escalating firms demand a whole lot: entrepreneurial spirit, creative imagination, a focused workforce, and also a strong program. nevertheless, much more than anything, they've two main needs: hard cash, and adaptability. numerous businesses ended up depending on ERC refunds to provide them with hard cash to continue to mature. But with IRS processing backlogs piling up, lots of entrepreneurs looking to improve are forced to turn to alternate options like superior-desire financial debt or supplying up fairness of their enterprise as ERC processing has stretched for years, with no conclusion in sight. So what are growth minded entrepreneurs to complete?

Enter the ERC Loan: A Tactical Advantage

An ERC financial loan gives an instantaneous injection of cash, utilizing your pending refund as leverage. contrary to standard financial loans, ERC loans don’t involve you to arrange loads of complex revenue projections or share your extended-phrase credit history background. Approval is predicated on the worth of one's claim, While using the lender taking over the risk of processing occasions Which may but stretch out for months or decades to come back.

And organizations that get these loans can easily undertake assignments that advantage them in equally the shorter and long-term. corporations can use these resources to pay for down substantial-curiosity financial loans and credit card financial debt, seek the services of critical expertise just before their competitors can, strengthen staff wages and Advantages to drive talent retention, start new services and products, invest in marketing and advertising and marketing at any given time when competitors are pulling back again and promotion has become more affordable, Create Doing the job cash reserves, and invest in purchaser acquisition. All of these pursuits enable companies to reap the benefits of owning money at a time when cash is becoming more expensive to acquire within the open up current market, and they may signify the difference between a business that doesn’t endure economic uncertainty and one that thrives in it.

Why Now?

a lot of business people may see all this and Consider “that’s all nicely and superior, but I’ve been waiting this extended – why not simply trip it out until eventually the IRS ultimately processes my declare?”

The solution is multifaceted. The most obvious solution, obviously, is the fact financial unpredictability and volatility are at this time working rampant by way of just about every aspect of the industry. With economic indicators shifting, getting cash now could signify your little small business can attain important ambitions including: locking in prices of resources and expert services in advance of prices rise all over again; Profiting from distressed property and alternatives like structures and capital items as competitors withdraw with the marketplace; preventing risky quick-time period borrowing at rates that seem to easily maintain mounting; and earning key investments in personnel and technological innovation that can place your company in advance of its competitors once and for all.

How an ERC personal loan is effective

An ERC personal loan is really a funding merchandise based on your accredited but unpaid ERC refund. you can get an advance on the anticipated quantity—commonly 70 to ninety%—and repay the financial loan when your refund finally arrives.

in some instances, firms go with a full ERC assert buyout, exactly where there’s no repayment associated. But even as a financial loan, this sort of funding is exclusive:

No new product sales required to qualify

minimum paperwork

depending on a credit you’ve by now gained

These things might make them notably appealing for progress enterprises Which might be confident regarding how they are going to use capital to fuel even more growth, but who is probably not capable to display the type of metrics that could qualify them For additional traditional financing merchandise.

ERC Loans vs. Equity Financing

a substitute for financial debt normally utilized by growing small business is equity financing – bringing in Trader profit Trade for an equity share of the business enterprise. the trouble with this tactic, needless to say, is dilution. as you’ve supplied up a bit of your company for a quick dollars infusion, it’s gone, along with your ownership share gets scaled-down. preserve cutting the pie into scaled-down and smaller sized pieces, so you’ll ultimately discover you don’t have much remaining for yourself.

Think about it by doing this: if your organization grows how you’re scheduling, will you be glad in 5 or a decade that you choose to experienced to give Section of it absent to finance that development? If the answer is no, it’s time for you to examine your choices.

What to Look for within an ERC Funding husband or wife

regardless of whether you’re exploring a loan or perhaps a claim sale, pick a firm that offers:

clear terms

No concealed service fees

No prepayment penalties

Responsive aid

demonstrated ERC encounter

You’ll need a staff which will go quickly, solution queries Plainly, and be certain compliance is rarely doubtful. At ERTC Funding, we provide the knowledge to have you the ideal answer, fast, and we provide the connections to make sure you obtain the mortgage with the absolute best phrases.

Real-entire world illustration: development Made feasible

Allow’s say your online business is suitable for just a $two hundred,000 ERC refund. nevertheless the IRS suggests it will not be processed right up until late 2026.

By funding $one hundred seventy,000 of that assert at the moment, you might:

repay $50K In brief-phrase personal debt

shell out $60K on the direct-generation marketing campaign

Use $60K to boost seasonal stock

In spite of comparatively affordable of curiosity payments, you occur out forward by Placing that money to operate now, not in 18 months.

Don’t Permit the IRS Decide Your Timeline

In these days’s industry, ready is pricey – perhaps prohibitively so. An ERC personal loan or declare buyout offers you alternatives any time you need to have them, assisting you continue to be ahead, not caught powering authorities delays.

discover your choices

choose to see how much you can unlock from the ERC claim? ERTC Funding (ertcfunding.com) features rapid, adaptable entry get more info with no complexity of conventional lending. Reach out nowadays and learn more about your choices.

Ariana Richards Then & Now!

Ariana Richards Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Pauley Perrette Then & Now!

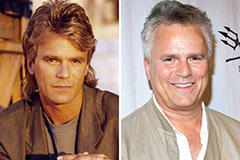

Pauley Perrette Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!